You’ve done it. You’ve built your business, surviving the ups and downs of the economy, the markets, even Covid. Now all the work is paying off and you’re ready to sell. You’ve got a potential buyer, and they suggest that you structure the deal as an asset sale. Should you care?

The answer is a resounding YES!

What is an Asset Sale and How is it Different from a Stock Sale?

- In a traditional stock sale, whether structured as a direct purchase of stock or as a merger, the buyer pays the stockholders directly for their stock. The Company doesn’t change, just the ownership.

- In an asset sale, the buyer pays the Company for its the assets: equipment, furniture, computers, intellectual property, software, contracts and anything else that may be of value to the business of the Company. The Company has changed dramatically – where it once was a going concern, it becomes a shell holding just the consideration in the deal.

The Perils of Double Taxation!

Why should you care if the consideration for your deal is paid to the stockholders or to the Company? One word: Tax.

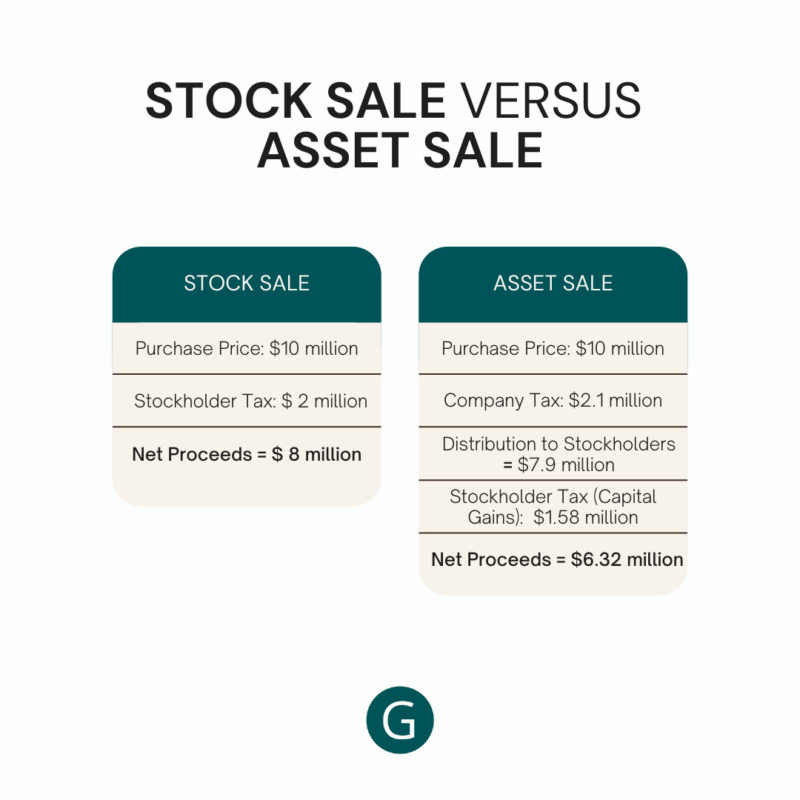

When the stockholders get the money, they each (hopefully) made a profit on the stock that they sold, and have to pay taxes on those profits. Under federal law, those profits are usually classified as capital gains, which (as of this writing) are up to 20%. There’s no escaping the taxman!

When the Company gets the money in an asset sale, it has to pay taxes on the profits it made in the sale as well. The federal corporate tax rate is currently 21% (and don’t forget about state tax). But wait! The money is held by the Company. The Company will need to make a distribution, and the stockholders will also need to pay tax on this distribution, most likely as capital gains. That means that the consideration is being taxed twice, first at the Company level, and then at the stockholder level.

Why Would a Buyer Insist on an Asset Deal?

If the Buyer buys the assets from the Company, they get what is called a “step up in basis” on those assets, meaning that if they subsequently sell the assets, their tax burden (which is based on the difference between the sale price and the basis) is lowered. Additionally, they can write off a significant amount of the sale price as the assets depreciate.

Why Would You Ever Agree to an Asset Sale?

There are a couple of reasons why a Seller would agree to an asset sale.

First, the Buyer may be willing to pay an additional amount to get the preferential tax treatment that they want. For instance, in our example above, if the Buyer paid $12,500,000 for the assets, the total net to the stockholders would be very close to the net received in a stock deal. A higher price can make up for a lot of deficiencies!

Connect with Jeremy Cohen for a free evaluation about your potential sale

Second, the Company may have accumulated a significant number of net operating losses. If the Company has been running significant losses for many years (as many start-ups do), this may cover the gains that the Company would receive in selling its assets in the sale. This is a win for both parties – the Buyer would get the step up in basis and the Sellers would pay taxes only at their personal level, not at the corporate level.

Other Considerations

Taxes are usually the primary consideration when determining whether a sale structure is preferential, but there are other factors to take into account, such as:

- Liabilities – In an asset sale, the Buyer will usually not purchase any of the Company’s liabilities. This means that the Sellers will need to continue to run the Company after the sale in order to satisfy these liabilities prior to winding up.

- Employees – In an asset sale, in order for employees to continue working after the sale, they would need to be terminated and then hired by the Buyer. There are potentially pitfalls in firing all of your staff, one being that under most state laws, you have to pay out all accrued but unused vacation time to terminated employees.

- Contracts – In an asset sale, each contract needs to be assigned to the Buyer. Many contracts require consent to assign, which means before you can close an asset sale, you may need to reach out to a number of counterparties and ask for their consent. Besides the hassle, this can delay closing, and could even cost some money if the contract partner is unwilling to cooperate.

- Benefits – After an asset sale, employee benefit programs will terminate and employees will need to be transitioned to the plans of the Buyer. A Seller who wants to look out for employees will need to make certain that the employees get credit for the time spent with the Company when determining eligibility in the Seller’s plans. Also, 401(k) plan will need to be closed out and the funds distributed, while can mean some administrative hassles.

Note that this discussion only relates to the sales of corporations. If your business is structured as an LLC or partnership, some or all of these factors may not apply to you. As always, check with your lawyer before agreeing to any deal structure!

Check out some of our latest posts…

- The Operating Agreement: Protecting Your New Business

- Securing Your Business From Cyber Threats

- Hiring An Attorney For Your Corporation

- Conversations With Claude 3

- Client Success Stories – Wicked Good Cookies

- Client Success Stories – BlueFin Technology Partners-Holios

- Trademark Protection and Cannabis Products

- What Does The Starbucks DEI Lawsuit Mean For My Company?

- Client Success Stories – Opti